An Insider’s Look into 2023 Insurance Trends

Take a deep dive into plan adoption rates, rising medical premiums, and the power of voluntary benefits for the new year.

It’s never too early to get a head start on prepping for the open enrollment season. And we’ve got just the right tool to help you through it. The Ease 2023 SMB Benefits and Employee Insights Report has arrived with every key insight, theme, and trend you should keep in mind while finetuning your employer groups’ benefits packages. There’s been a lot of changes in the past few years due to rising inflation costs and newer generations entering the workforce. The lasting effects aren’t going away anytime soon, and it’s time to embrace the change. Learn each and every detail about plan adoptions, the effects of the rising inflation rates, and the importance of voluntary benefits for your employer groups’ employees.

To waive or not to waive — that is the question.

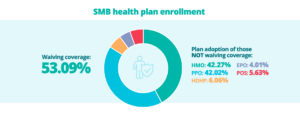

Have you noticed fewer employees enrolling in medical insurance during your recent open enrollment? You’re not alone in this experience. The number of employees choosing to waive coverage increased to 53.09%. The smaller the employer group, the fewer employees enrolled.

Continuing previous years’ trend, larger employer groups end up offering more health plans than the smaller employer groups. A deeper look reveals that groups with 101-250 employees even increased the number of health plans offered while all other employer groups decreased the number of plans offered last year. Employees that can afford to spend a little more on health insurance will pick a plan with a lower deductible and higher monthly cost, while the newest generation has different ideas. Every year, there is a new group of Gen-Z employees aging out of their parent’s insurance and they’re opting for the most affordable plan. A new study conducted by Lively reveals that 63% of Gen Z can’t afford preventive care. While you’re selecting the plan options for this year’s benefits package, make sure there’s an affordable and effective choice for the younger employees.

A collective sigh was heard from everyone’s wallets.

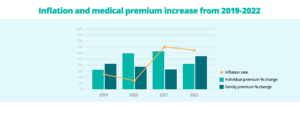

The increasing percentage of employees waiving medical coverage could be explained by the increasing cost of medical premiums. Since 2018, individual premiums have increased by 21% while family premiums have increased by 18%. To put it into dollar signs, that’s an extra $104 for individuals and $231 for families each month for medical insurance.

The effects of rising inflation costs can be seen in every grocery store, gas station, and even health insurance. In the last year, U.S. consumer prices rose 6.5% for all goods. Take a guess at who’s beating that average — health insurance premiums. The Ease SMB Insights Report found that health insurance premiums have increased by at least 7.9% in 2022. The smaller employer groups with 1-10 employees are feeling it the most with an increase of 12.07%. That’s the largest increase this group has experienced in the past four years.

When considering the costs of medical premiums, it’s less of a surprise when taking a look at the plan adoption rate last year. Even though employer groups are taking on more of the weight, it’s difficult to take on the added expense of medical insurance. On average, employers are covering 72.78% of the medical premium contribution for individuals and 61.38% for family premiums.

The secret weapon: voluntary benefits.

Medical plans are crucial in any benefits package but don’t count out the voluntary benefits. When it comes to increasing employee retention and engagement, a benefits package that meets every one of their needs makes a world of difference. In fact, a study conducted by Corestream revealed that 3 out of 4 employees want their employer to offer more voluntary benefits. This stat has been heard loud and clear by small and medium-sized businesses.

On average, SMBs offer nearly four voluntary plans to their employees. Break it down further and you’ll see that businesses with 101-250 employees offered nearly six plans, while the smallest segment of 1-10 employees offered two. And these numbers keep increasing. Since 2020, the number of voluntary benefit plans has been ticking up year after year. From the smallest groups to the largest, each year shows steady growth in the plans offered in their comprehensive benefits package.

Whether benefits packages include dental and vision, long-term and short-term disability plans, or even newer lifestyle options like pet-care benefits, listen to employees’ needs and tailor the package for ultimate employee satisfaction.

Stay competitive with the right tools in your back pocket.

Benefits and enrollments may be evolving, but you don’t have to fall behind. Have conversations with employer groups and, even, their employees to discover their specific needs. Keep one finger on the pulse for the latest insurance news by subscribing to newsletters and following the latest on LinkedIn, Facebook, and Twitter.

Psst: Stay several steps ahead by downloading your own copy of the 2023 Ease SMB Benefits and Employee Insights Report.